Featured in The Economic Times

New Delhi: Samunnati on Monday said it has raised EUR 10 million (around Rs 90 crore) in debt to provide loans to farmer producer organisations (FPOs) and SME agri businesses. Founded in 2014, Chennai-based Samunnati said in a statement it has raised EUR 10 million from FMO-Entrepreneurial Bank as well as Triodos Fair Share Fund and Triodos Micorfinance Funds, the two financial inclusion funds managed by Triodos Investment Management (Triodos IM).

“FMO and Triodos IM have committed EUR 5 million each in debt to Samunnati Financial Intermediation & Services Pvt Ltd, a non-banking financial company (NBFC) in India, to help the company expand financing and technical assistance to low-income farmers and enterprises throughout the in India,” the statement said.

This follows the earlier debt financing round of USD 20 million which was extended by US International Development Finance Corporation (DFC).

Samunnati offers customised financial, co-financial and non-financial solutions to farmer producer organizations and agricultural enterprises across the value chain.

The company exclusively works in the agriculture sector.

“The company plans to use the funds to make loans to FPOs and SME agri businesses that are currently underserved by the formal financial system,” it said.

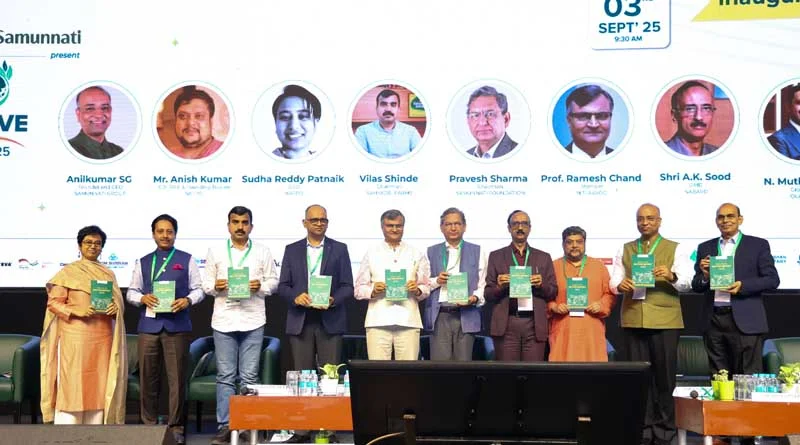

Anilkumar SG, Founder and CEO, Samunnati said, “Samunnati is working with FPOs on the supply side and agri Enterprises on the demand side across 19 states in India. We are delighted to partner with FMO and Triodos Bank as this will help us further offer customized financial solutions, using social and trade capital, to FPOs and SMEs, enabling the agri value chain to operate at a higher equilibrium.”