Chennai-based Samunnati Financial Intermediation and Services Pvt Ltd, has executed the issuance of Non-Convertible Debentures (NCDs) aggregating to $5 million. The latest NCDs were subscribed by FMO, the development bank of Netherlands that provides meaningful and responsible investment opportunities to businesses focused on environmental sustainability in developing countries.

The investment was made through MASSIF, a Dutch government fund managed by FMO. The funds will be utilised by Samunnati to support small-holder farmer organisations and Agri-enterprises by financing their working capital requirements. Samunnati is an agri-value chain finance firm.

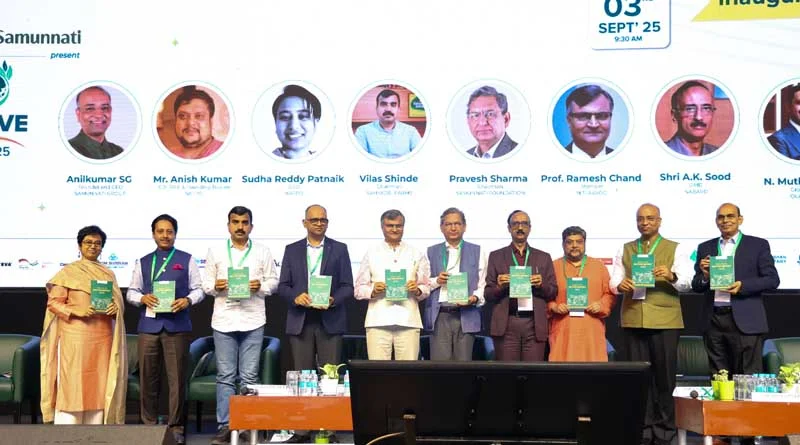

Anil Kumar SG, MD & CEO, Samunnati Financial Intermediation & Services Pvt. Ltd said, his company and FMO share a strong synergy focussing on agricultural value chains with a view to providing working capital solutions, linkages with markets and advisory services to enable value chains to reach a higher equilibrium.

Traditionally, informal sources have been the main source of finance for agriculture value chains whose needs are generally too large for microfinance, but too small for commercial banks.

This combined with the absence of product customisation to suit the cyclical requirements of the agri-value chain players creates a gap that hampers growth and limits agricultural development, he added.

Despite various efforts of stakeholders in this area, there continue to be huge demand-supply mismatches in financing the agri-value chains and enterprises. To address this huge gap within the agriculture ecosystem, Samunnati leverages the social capital and trade capital in buyer-seller relationships via aggregators, through non-traditional sourcing, risk assessment and mitigation, aided by cutting edge technology, thereby building a quality business that is sustainable and results in inclusive growth.

“Our vision is to establish that agricultural lending is not risky as long as the products and services are structured specifically for them. In agriculture, cash flows are seasonal and cyclical. The products that you deliver should appreciate that. Secondly, we want to establish the principle of collectives and the power of aggregation,” added Anilkumar.

Since its launch in 2014, Samunnati’s present across 14 states and has so far disbursed over Rs 1,400 crore worth of credit, impacting 2 million farmers, indirectly.