Featured in FINANCIAL EXPRESS

Several tech innovations including AI and ML, are being increasingly launched by enterprises to help farmers enhance farm productivity, take well-informed decisions, and connect them to the larger ecosystem to discover synergies. However, there continues to be significant information asymmetry and lack of meaningful data about developments in the ecosystem, which can facilitate the exchange of information and help key stakeholders introduce strategic data-led policies and interventions.

Discrepancies across the value chains can be managed, to an extent, by leveraging technologies such as blockchain. Typically, blockchain is viewed as a technology that facilitates the decentralisation of information, allowing easy access to all the members throughout the value chain. Today, agri players are increasingly looking at opportunities, where this technology can be applied to simplify financial procedures, as well as to integrate all the stakeholders in the agri sector. From input suppliers to farmers and credit suppliers to logistics providers, these stakeholders can be brought onto a single platform to interact, share and consume data in a secure and transparent environment.

Solving information asymmetry in the ecosystem

Given the multiple players across multiple steps and levels of the value chain, there is a huge volume of data generation and transactions on a daily basis in the farm sector. However, the availability of data and maintenance of records continues to be very poor. One of the inherent challenges that the sector still faces is that there are no records available on the transactions that occur at the farmer level, due to multiple channels and no appropriate means of recording.

There is a need to trace transactions throughout the agri value chain right from FPOs, input suppliers to how the product was procured and sold to the institutional buyers. Blockchain can help structure various financial services products which will bring a lot of cohesiveness in how organisations engage with the FPOs. It can connect FPOs with vendors, food processors, and packaging firms, allowing buyers and sellers to interact without an intermediary in a secure and trusted environment. It also eliminates the requirement for intermediaries to be paid out of farmers’ margins, thereby increasing their profit portion.

Blockchain will improve asset traceability, provide accurate data on farmers’ input requirements to input suppliers, and inventory data to output providers. This will help estimate future cash flow predictions, enabling lenders to purchase inputs on behalf of the farmers’ and provide trade finance. For example, the Maharashtra State Warehousing Corporation (MSWC) recently announced its plan to introduce this ledger technology to help farmers access commodity finance faster. Similarly, the University of Hyderabad, in collaboration with players such as Samunnati, Synchrony IT and Social Education Economical Development Society (SEEDS) announced an integrated blockchain solution to bring the entire agri ecosystem, from farmers to financing experts to a single platform.

A recent EY report suggests that agritech in India is still in infancy with just 1% penetration of the addressable market potential of $24 billion. Although the agriculture sector has started deploying technologies such as blockchain, in the coming years it will definitely find more applications in solving many other problems faced by farmers. This will span finance, accessibility to resources and information, networking and multiple other aspects.

About the Authors

Sridhar Easwaran – SVP, FPOs

With 35 years of experience across operations, project management and risk management in the banking industry, Sridhar has worked at PWC and HDFC Bank.

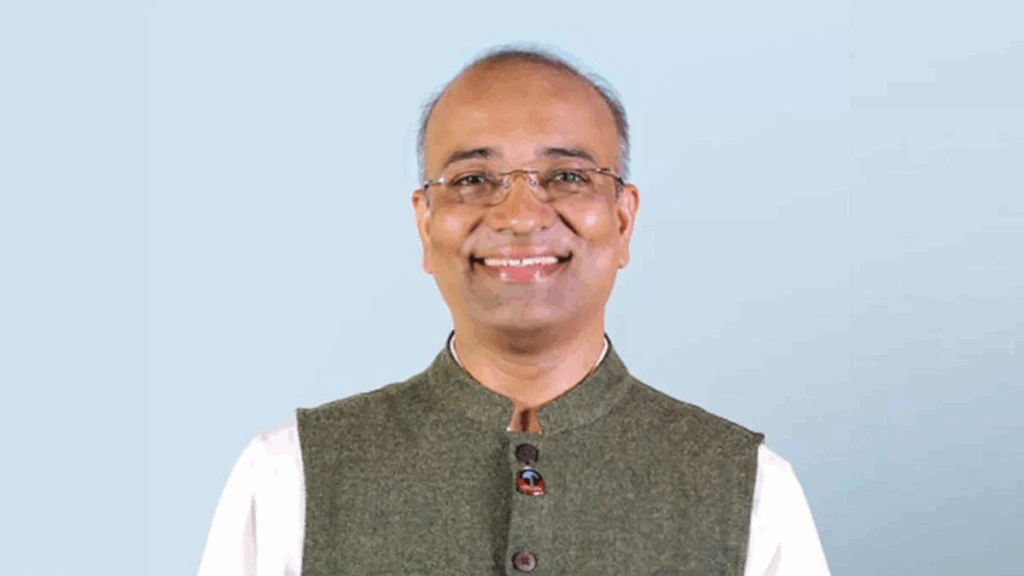

Prof Vijaya Bhaskar Marisetty – University of Hyderabad

Prof Vijay’s current work focuses on emerging markets corporate finance, financial regulation and machine learning applications in finance.