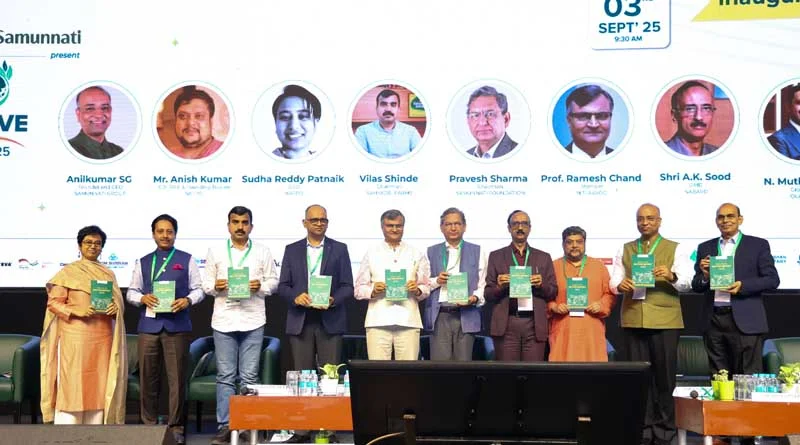

Featured in The hindu businessline

Says gross transaction value of its interventions are touching $3 billion-mark

As it enters its tenth year of operations, agri-value chain financier Samunnati says the gross transaction value (GTV) through its interventions in Indian agriculture is seen topping $3 billion (₹22,000 crore) and the company plans to focus on lending to climate and sustainability initiatives, including restoration of soil health in the years ahead.

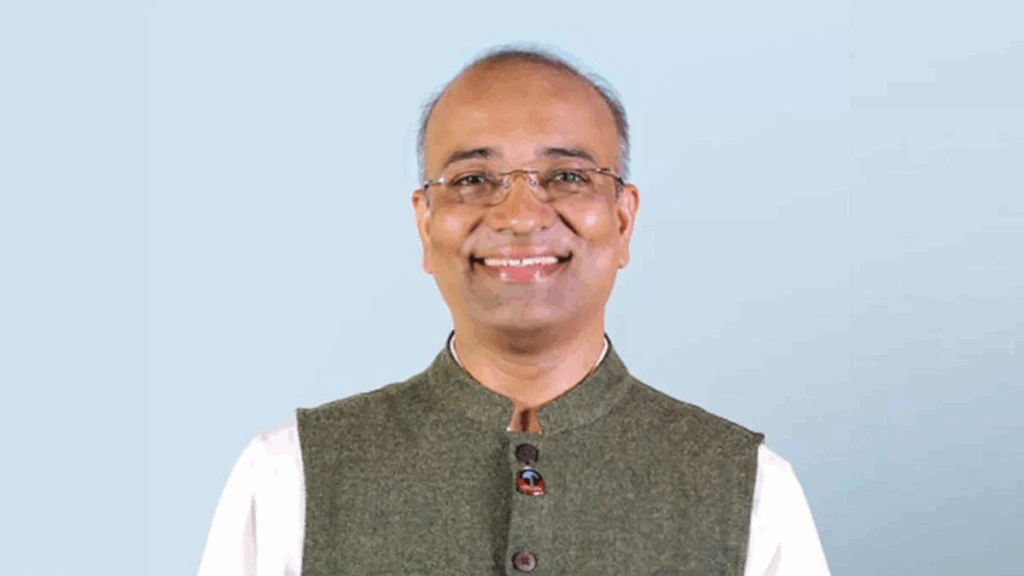

The journey so far has been like peeling off an onion with one thing leading to the other. What has remained constant is the purpose that exists — to make market work for small holder farmers,” said SG Anil Kumar, Founder and CEO, Samunnati Financial Intermediation and Services Pvt Ltd.

Founded in 2014, Samunnati had taken the approach of AMLA – aggregation, market linkages and advisory services, helping the farmers producers organisation (FPOs) and agri-enterprises connect to the markets by funding their credit requirements.

Attracting 6,500 FPOs

“We started with lending and within one-and-a-half year of lending we realised that market linkage is an important dimension and we started offering market linkages and then we realised that the technology is an important dimension to bring. We launched our foundation as well as our FPO Next, which is a digital platform. Today in terms of what we should be doing is how we solve the dimension of access for the farmer in an FPO. We are basically solving for the dimension to access to finance, access to market linkages, access to infrastructure, access to information, access to technology and access to advisors,” Anil Kumar said, tracing the growth of the company’s journey.

The Chennai- headquartered Samunnati has made a significant impact on the Indian agriculture over the past 10 years. “The gross transaction value between both the lending and the market is inching towards a $3-billion market. That’s the kind of throughput we have brought in by focusing exclusively on agriculture,” Anil Kumar said.

FPO Next has managed to attract around 6,500 FPOs, about a fourth of such farmer collectives in the country. “The platform is the landing space for all the FPOs. We have lent to about 50 per cent of the 6,500 FPOs on the platform and that would make us the largest lender in India on the FPO front,” Anil Kumar said. Besides the FPOs, Samunnati has also worked with about 4,000 agri enterprises on the value chain solutions basis.

N-E projects

On the company’s focus on lending to climate and sustainability initiatives, Anil Kumar said Samunnati has already issued bonds around sustainability. “We are already lending to these initiatives that we have set up a separate team for it and we also have a board-approved ESG policy” he said adding that the focus would be more on initiatives that take to play a role in creating safety nets for the farmers and FPOs.

Over the past 10 years, Samunnati has expanded its footprint across 24 States.