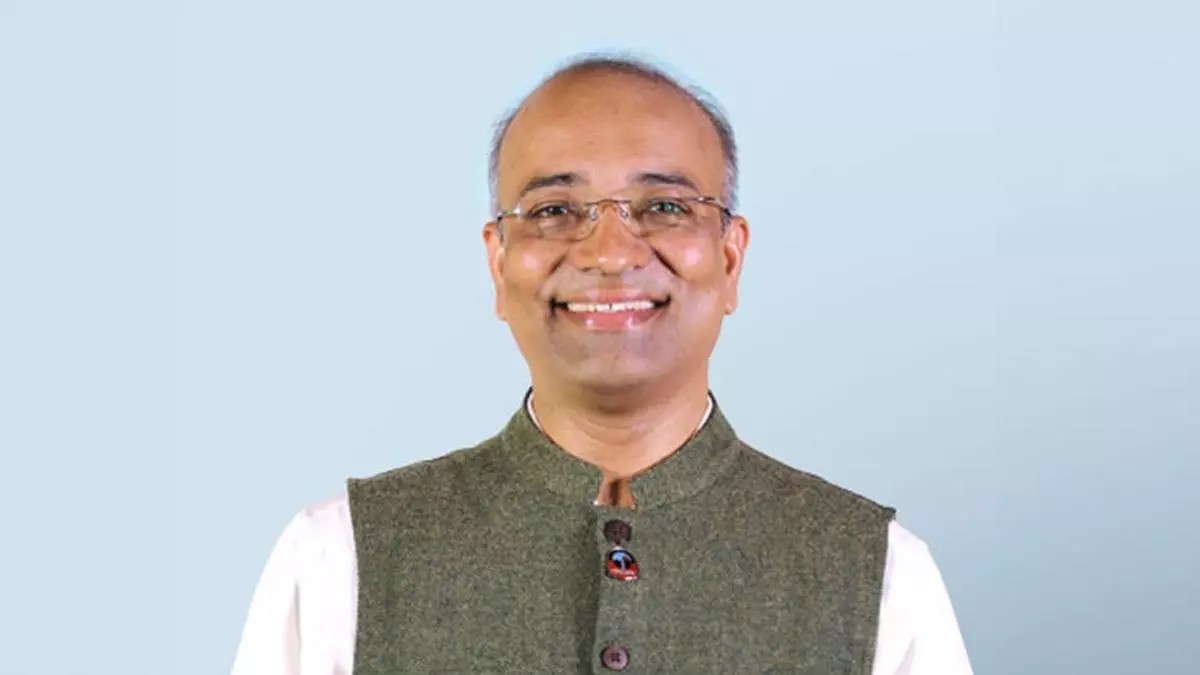

Samunnati, the Chennai-based NBFC operating in the agricultural space, has a unique model to fund agri-related activities. While most financial institutions that give out crop loans have their balance sheets littered with bad loans, Samunnati has been successful in getting repayments on time. Samunnati promoter and CEO SG Anil Kumar opens up on the secrets behind the NBFC’s success in a telephonic interview with BusinessLine:

How different is Samunnati from other lenders?

We follow a value- chain finance model. We work one or two levels above the production cycle to impact the farmer positively. We don’t take away the middlemen. Our realisation is that middlemen play multiple roles in the lives of farmers. They create the market, take the credit risk and most importantly, they are also lenders to farmers.

Our approach is what we call AMLA approach — aggregation, marketing linkage and advisory services. How can we leverage the power of aggregation? It is where a set of producers engaged in the same economic activity come together for their collective welfare.

On the production side, it is about the collective benefit, bargaining to reduce the price of inputs. On the procurement side it is about leveraging collective bargaining to aggregate the produce and sell. We give customised working capital solutions to FPOs. It could be a three-month, six-month or one-year loan, depending on the requirement. The market linkages are where we work on the demand side of the value chain.

Where do you raise your capital?

We have private equity investment. Our investors include Elevar, Accel Partners and responsAbility. Our capital base is around ₹200 crore. We are a four-year-old company. We focus on five sectors, namely livestock, commodities, fresh fruits and vegetables, food processing and inputs.

How much have you given out as loans so far?

We have lent around ₹1,100 crore so far, and operate in 31 value chains, operating in 14 States. Dairy is a value chain, spices is another and so is maize. We work with 400 community- based organisations, or farmer collectives. They can be FPOs, societies, or cooperatives. These farm collectives have a cumulative membership base of 1.2 million farmers.

What is your bad debt level?

Our model is built for a loss of 2 per cent. We have not incurred that much, but we have provided for it. We have reserves for that kind of loss. To determine the quality of a portfolio, there is something called 90-plus DPD (Days past due). Our 90-plus DPD is around two per cent. We customise our loans and the tenure of our loans ranges from four days to five years. The quantum ranges from ₹5,000 to ₹10 crore.

Do you deal with individual farmers?

We do deal with individual farmers, but only through collectives. Our model is entirely cashless. We give them a card with a limit, which can be used only to buy inputs. This helps in two ways. It will take care of the timely availability of inputs. The output of an FPO in Madhya Pradesh, associated with us, could increase by 50 per cent just by applying inputs on time.

People consider agriculture risky. Most of the risk comes not from the underlying activity, but the way the marketing is done, particularly by the lender. You have to customise the solutions. If you don’t, money is at risk.

Where do you see yourselves five years from now?

Our vision is to establish that agricultural lending is not risky as long as the products and services are structured specifically for them. In agriculture, cash flows are seasonal and cyclical. The products that you deliver should appreciate that. Secondly, we want to establish the principle of collective and power of aggregation. Third, we want to establish that any financial player working in the agri space should not just be a lender. You have to understand the risks of the farmer and mitigate them. You cannot create a structure where your interests are protected, not that of your farmer. When you are lending to a farmer, make sure for what activity and that this activity gives him or her the anticipated income. It is from this income that they will repay your loan.

Leave A Comment