Featured in ET BFSI

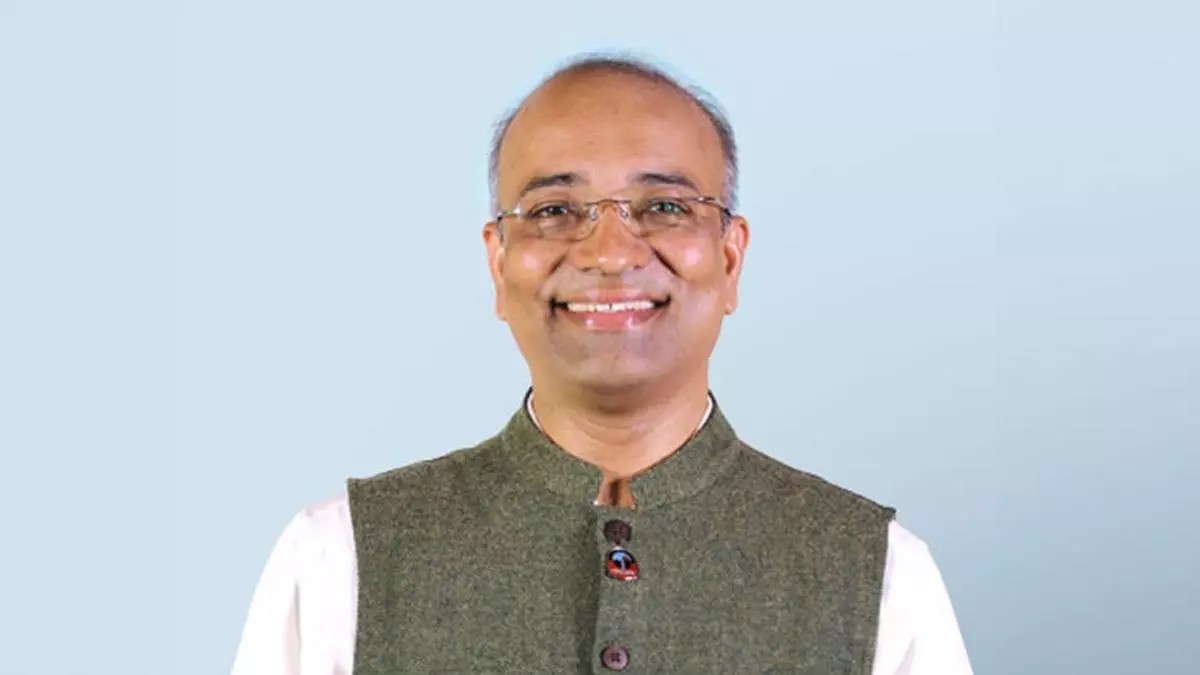

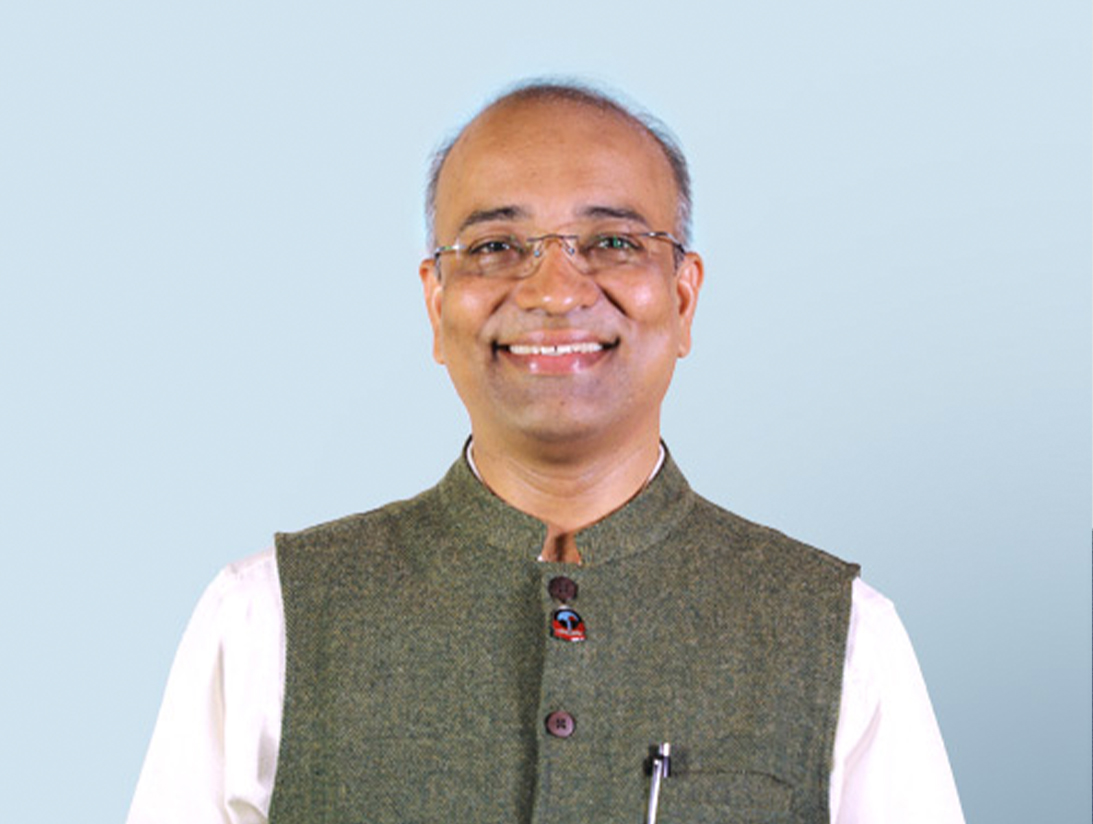

Anil Kumar S G was inspired by Muhammad Yunus biography to establish Samunnati, an agriculture financing enterprise in India. Founded in 2014, Samunnati focuses on improving the value supply chain from farmgate to plate. It has expanded to 23 states and works with 5,500 farmer producer organizations (FPOs) and farmer producer companies (FPCS) Kumar, with 27 years of experience in banking, emphasizes that the majority of people in the agriculture sector are honest and trustworthy.

Anil Kumar S G flew to Manila to pursue a masters at the Asia Institute of Management in 2004. His goal was to switch from banking to academics. But, in the Philippines, he stumbled upon a biography about another banker, which inspired him to build an agriculture financing enterprise in India 10 years later.

“The biography of Bangladesh’s Muhammad Yunus, father of microfinance, deeply impacted me. I went to Manila to become a professor on returning home. I had no clue about microfinancing till then. His biography on how a $26 corpus can create livelihoods for millions in the world changed my focus to the rural economy,” says Kumar.

By 2014, he had set up Samunnati, focused on improving value supply chain from farmgate to plate. Founded with an investment of ₹88 lakh, it has expanded to 23 states, with an annual gross transaction value of ₹6,000 crore.

Kumar of Kolar in Karnataka did his schooling in Ballari (also in Karnataka) and Anantapur in Andhra Pradesh. At 18, he took up a clerical position in Canara Bank and gave up on a mechanical engineering degree because his family couldn’t afford it. He had studied in an engineering college at Tumkur for six months. He joined Canara Bank at Belagal in AP’s Kurnool district in December 1991. “It gave me an exposure to how financial services can have a direct impact on farmers,” he says.

In 1996, Kumar joined ICICI bank in Hyderabad. After stints in branches at Hyderabad and Guntur, he went to Manila. That’s where he learned about Muhammad Yunus and returned to join the rural micro banking and agri business group at ICICI Bank’s head office in Mumbai in 2005. He worked with community-based groups and NGOs for two years to expand the bank’s microfinance footprint.

An initiative by the bank to set up the Institute for Financial Management and Research (IFMR) brought him to Chennai. It established units in Thanjavur and Thiruvarur districts offering a range of financial services to low-income rural households. “We became part and parcel of their financial management because one wrong decision by a low-income household can verty forever,” he says. Kumar resigned from ICICI Bank, but continued as CEO of IFMR’s rural channels and rural finance.

In June 2014, Samunnati commenced operations from Kumar’s house in Chennai with three employees. It started off as a dairy value chain at Tiruvannamalai, which took it to the dairy hub of Chittoor in Andhra Pradesh and to Gujarat. This opened up opportunities for a cattle feed value chain and an entry into Madhya Pradesh for maize and soya.

Later, it forayed into the poultry and fisheries value chains. In July this year, the company facilitated farmgate procurement for export of 275 tonnes of Thomson seedless grapes to the Netherlands. Today, it is working with 5,500 farmer producer organizations (FPOs), farmer producer companies (FPCs) and societies with a membership of 8 million smallholder farmers, besides 4,000 agri enterprises across the country.

It has also lent ₹400 crore-₹500 crore to 250-300 agri startups. “We fund farmers through aggregators such as FPCs and FPOs. While most of the other entities saw a scope in FPOs only in 2019-20, we saw a business in the FPOs in 2014 itself,” says Kumar. Now, the company operates with 600 employees and 50 offices.

Asked why several investors are cautious about the agri sector, Kumar says a lot of these apprehensions are due to a lack of understanding about agriculture. “Of the 32 years of my experience in banking, I spent 27 years with farmers, rural and agri households. Almost 99.9% of people are honest and trustworthy,” says the 51-year-old.

Leave A Comment