Akriti Negi, Senior Manager, CSR & Partnerships, encapsulates how Samunnati has actively engaged with Farmer Producer Organisations (FPOs) since 2016. In this blog, she focuses on the key challenges faced by small-holder farmers and the need for farmer collectives; and how Samunnati’s AMLA approach is addressing key challenges faced by FPOs, thereby impacting smallholder farmers.

Collectivisation of farmers has emerged as a keyway to address the challenges faced by smallholder farmers. Farmer collectives, specifically Farmer Producer Organisations (FPOs) aim to improve the farmers’ income by aggregating the production and demand of their member and leveraging on the bargaining power through aggregation.

Challenges of Smallholder farmers due to fragmented landholdings in India:

- High cost of cultivation

- Limited access to formal credit. Only 2% of the working capital requirments and 10% of the term loan requiremen of the FPOs are met1

- Lack of access to alternative markets

Many of the FPOs have helped the farmers to strategise their market activities in a better manner by providing benefits of aggregation like collectivisation, value addition, storage and processing of the produce. FPOs also help aggregate the finance and input requirements of the member farmers, thereby acting as a vehicle for financial inclusion of the unserved and underserved farmers. Given the benefits of collectivisation and based on the success of Farmer Collectives in Gujarat (Milk) and Maharashtra (Sugar), several initiatives have been undertaken by Government, Apex financial institutions such as NABARD, SFAC, NGOs, private donor organisations and financial institutions to promote and strengthen FPOs in India over the last fifteen years.

Challenges Faced by FPOs

However, while the benefits of farmer collectivisation are evident, the FPOs face some critical challenges. There are about 50002 FPOs in the country and most of them are still considered as nascent and still finding their way to sustainability. The promoting institutions provide support in the form of grants, trainings, and financial aids, which enables FPOs to mobilise farmers, set up initial structure and framework till they establish and manage their organisations on their own. Once established and they start running their business, these FPOs lack access to working capital and markets to sell the produce and buy the inputs. At the same time, they face challenges around governance, management, financial management, business operations due to lack of exposure, business acumen and knowledge.

Creating Appropriate Solutions for FPOs

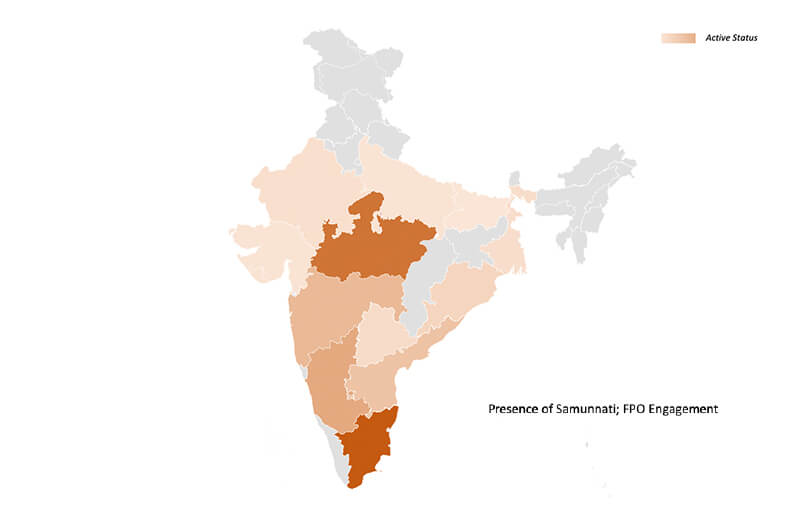

Samunnati believes that in order to create maximum impact across the value chain and on small holder farmers, FPOs are well-placed and bear huge potential. Samunnati started working with FPOs in year 2016 and built a comprehensive FPO engagement strategy for the holistic development of the FPOs through customised financial and non-financial solutions. Instead of creating its own parallel structures, Samunnati focuses on strengthening the existing network of FPOs promoted by various Resource Institutions (RIs) and NGOs like ASEEFA, SEEDS, ASA, Reliance Foundation and so on and Producer Organisations Promoting Institutions (POPIs) like NABARD and SFAC.

Using its comprehensive AMLA (Aggregation, Market Linkage, Advisory services) approach, the FPO specific engagement plan is prepared where Samunnati connects the FPOs with institutional buyers, provides capacity building services, advisory to the FPO for business activities, financial management, compliances and value addition activities and so on. In addition, Samunnati provides support in institution building through its Relationship Managers (RMs), who interact with the FPO consistently and design the intervention plan. Further, for the working capital requirements of FPOs, short term input and output procurement loans are provided based on the non-traditional assessment by its experienced credit underwriting team. As a result, Samunnati has been able to reach around 450+ FPOs which in turn have an outreach of 4 million farmers, in a span of less than three years.

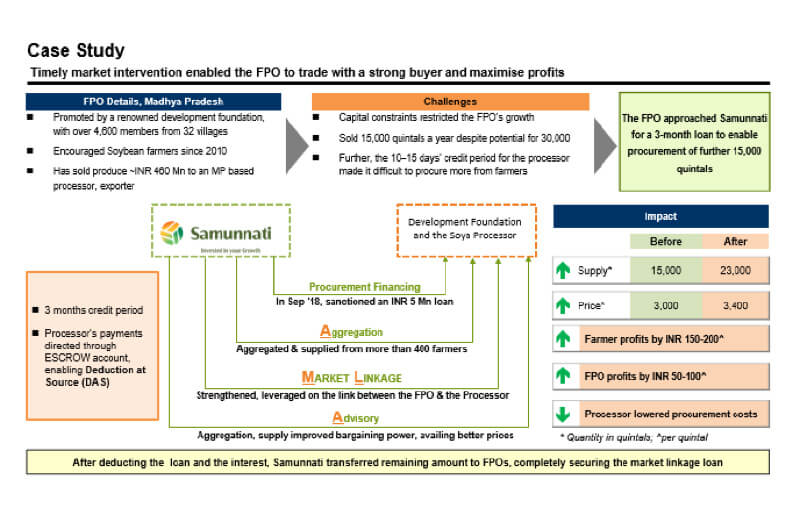

The example below illustrates how Samunnati’s AMLA approach has been able to create impact on one of Samunnati’s FPO client’s business –

Road Ahead: What’s Next in the Pipeline?

Samunnati in its efforts to strengthen the FPO sector and create a structured change at the ecosystem level is working on key areas such as institutionalisation of grading tool, digital stack for FPOs, FPO as a service model, agri entrepreneur model, piloting capital structures, and so on. Samunnati believes that these solutions for FPOs will result in a transformational impact on the agriculture sector, boosting smallholder farmers income and farm productivity.

Samunnati has already started actively collaborating with other ecosystem players in order to pilot some of the high impact, innovative solutions for the FPOs. For instance, to channel formal capital from the mainstream financial sector in farming as an activity, Samunnati is working with International Foundations to develop FPOs as an asset class. In order to achieve this, Samunnati has identified important areas of intervention such as access to finance, access to markets, capacity building and access to technology in order to have a focused approach in bringing sustainability and profitability to FPO business models. All these potential interventions will enable FPOs to play a pivotal role as ‘value-led enterprises’ in the long term ensuring better returns to its member farmers.

For more information on Samunnati’s work with FPOs, click here.

To collaborate/ contribute, write to Corporate Communications Team –communications@samunnati.com

Editor’s Note: The upcoming FPO series blog will focus on these areas of intervention taken up by Samunnati. We have partnered with other like -minded entities to work on these areas and excited to share some of the valuable learnings and insights from the ground.

Sources