Introduction

Agricultural produce globally has an inherent tendency towards price volatility, mainly driven by the global or domestic supply and demand market fundamentals. Agricultural markets are inherently unstable. Because demand and supply of crops are fixed in the short run, prices fluctuate widely within a season and from one year to the next. Agri-producers are therefore much more vulnerable to price shocks than other industrial sectors. This vulnerability became particularly clear during the fallout of the global financial crisis in 2008, which initiated a period of high variations in the prices of agricultural products. As a result, the issue of price volatility in Agri-commodities has come to the forefront of public policy attention in recent years. This has been especially the case in India, where small and marginal farmers have been gradually exposed to these global price fluctuations due to the increased globalization.

To mitigate such price risks, there have been efforts across the globe by the policymakers considering the need for specific risk management instruments to tackle price volatility and/or enable farmers to deal with its negative consequences. While there are several possible tools to achieve this, such as insurances and specialised financial instruments, the push for the adoption of “futures” and “Options” comes when agricultural markets shift from government-regulated price stabilisation policies to a free market.

The exchange lacked huge participation from the Agri sector in India because of various factors as discussed below. Farmers’ participation has been limited on Agri-futures, primarily because of a lack of understanding of such instruments. Planting decisions by farmers in India are focused on past year’s prices rather than future price projections, which leads to a vicious cycle of production & price volatility. A market needs a wide array of products that offers flexibility for effective risk management that makes them valuable for the Farming community a one-stop marketplace for all the produce from their activities and to choose the right one for them. In India, only domestic brokers were allowed initially and large Bank broking entities, AIF’s, Mutual Funds, PMS’s were missing hence the depth was always missing due to which large corporates were never participating with full confidence. Also, large banks as clearing members were missing which caused a lack of confidence in the large corporates to hedge on Indian exchanges. Efficient deliveries mechanism is of utmost importance for a well-behaved commodities derivatives market to ensure a threat of delivery to avoid over speculation. Despite its ups and down’s over the years, these markets have served as a source of price discovery of Commodities in India for various stakeholders around the world.

Advantages

Instruments like Futures are a risk management tool. Futures contracts give farmers the possibility to ‘lock in’ a certain harvest price for (a part of) their agricultural production, thus excluding the possibility that their selling price will fall in the future. This method is commonly referred to as ‘hedging’. As a result, farmers do not have to cope with price volatility for these commodities anymore, as the risk of price changes is transferred from the farmers to speculators, who are willing to accept this risk in the hopes of making a profit out of it.

Secondly, Futures can also be valuable as an instrument for price discovery. As futures markets reflect the price expectations of both buyers and sellers, they allow farmers to estimate the future spot prices for their agricultural products eliminating unstable markets.

Call options — that give the government the right, but not the obligation, to buy, say, pulses when prices rise — will reduce the need for accumulating physical stocks and add transparency by setting clear rules for government intervention. Potential speculators will get a strong signal to desist from hoarding.

Options can enable FPOs to manage commercial risk in the production, processing, and marketing of agricultural products. Through the ability to use options, processors and merchandisers can pay farmers the best prices for their crops and give consumers lower prices for food.

Options are the next step after crop insurance. Crop insurance only protects farm income against loss of harvest. Options protect farm income from the harvest that is reaped.

Challenges

Farmers are confronted with variety of costs like brokerage costs, initial margins, and mark to market margins (if futures experience negative price developments.

Trading requires a significant amount of technical know-how of the markets and regular information on daily price changes which farmers are largely unaware of.

The speculation on futures markets can artificially increase the demand for agricultural products, and thus lead to higher prices on the physical markets. This may give misleading signals which guide future production decisions. They can also threaten the income of farmers engaging in futures, as their

Futures & Options are the future of Indian farmers and FPOs Can Play a Hugely Enabling Role

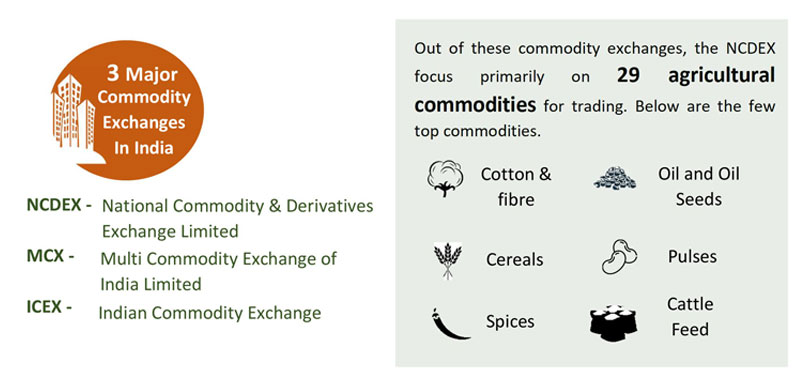

Indian Agri-sector is largely defined by small landholdings by individual farmers. FPOs have facilitated small and marginal farmers to address many agricultural challenges collectively, such as improved access to investment, technology, markets, etc., and to ensure better income for producers through joint efforts. Commodity exchanges in India require that each Agri-commodity be traded in a minimum quantity which is often not met by small and marginal farmers. Their produce may not always qualify for the quantity and quality requirements needed to be met at Agri -commodity exchange platforms. On the other hand, traders in the conventional marketing networks provide them with convenient access to both credit and business, while charging high commission fees, and largely constraining farmer’s participation in instruments like Futures and Options.

Aggregation to form FPO has the following advantages –

- Small and marginal farmers can mitigate their price risk regardless of the size of the crop they produce

- Cropping decisions can be made based on next year’s prices rather than last year’s realized prices

- The use of commodity exchange platforms can interrupt the vicious cycle of low income for smallholder farmers and lack of market access.

- Small and marginal farmers can obtain post-harvest loans for goods deposited in warehouses using warehouse receipts.

- The settlement mechanism of these options contracts is based on spot price and all open positions convert into a physical settlement on expiry of the contract. Such instruments can be beneficial for farmers and farmer groups to lock their price and hedge against any adverse price movement.

- In Options, A one-time payment of premium gives the right, but not the obligation, to buy or sell a commodity to another party at a specific price on a specified date. By paying the relatively small premium, FPO will ensure the minimum price. If the market moves up, the premium FPO paid for the option will be lost. But the FPO will be able to capitalise on selling the produce physically at higher prices.

The promotion of FPOs by SFAC, NABARD & other government agencies has been a gamechanger to enable smallholder farmers to utilize the power of aggregation to have better price discovery and market linkage opportunities. FPOs play a vital role as aggregators and can connect farmers to the derivatives market. It should be noted here that, although the formation of FPOs is not a necessary precondition for participation in the exchange, it is nevertheless a very enabling condition that can facilitate greater participation of farmers in the exchange.

Leave A Comment