This is the case study of a FPO, promoted by an NGO based in Madhya Pradesh. The FPO was incorporated in 2013. Being a young organisation, this FPO also had its own challenges in providing services to its members. By 2017, the FPO has a turnover of Rs. 2.6 million and has a woman as its CEO who had joined the FPO as an accountant in 2013. The lady was nurtured to become the CEO and thanks to her hard work as well as the leadership development efforts of the NGO, which is the promoting institution of this FPO. The case study captures the journey of this FPO.

In 2016, based on the request of a few community members, the NGO decided to focus on the FPO. Because of the lady’s earlier experience in the FPO, she was chosen to lead the organization as the CEO. Though anxious of the responsibility being offered, she took this as a challenge and accepted

the offer. The CEO and her team worked relentlessly by visiting every member individually to understand their requirements and how “their FPO” can cater to their requirements. To take up a few income generating activities, the CEO also started her efforts in securing resources from Banks/Financial Institutions for their growth plans. Given the stage of the organisation and not having sufficient track record, securing a funding line from a formal financial institution was not easy. Finally, through the NGO, the CEO approached Samunnati for their funding needs.

The officials of Samunnati engaged with all stakeholders of the FPO, as part of their diligence process, which lays emphasis more on the social capital that exists between the FPO and its members than the past history and track record. Samunnati in collaboration with the NGO conducted a series of brain-storming sessions with both the BODs and the team members to understand their strategies and business. Based on this diligence and the confidence in the team, Samunnati sanctioned a loan to the FPO to take care of their requirements as per their plan. The CEO was also keen on expanding the business through procurement & value addition of Potato, Onion and Paddy.

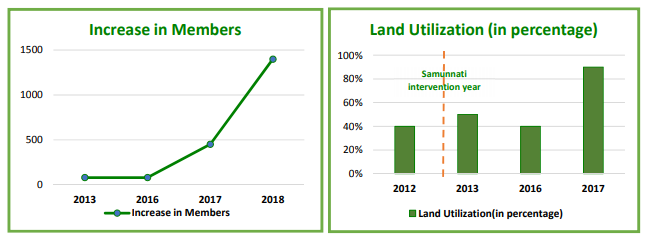

By mid-2017 the FPO had gradually started to scale. The FPO started offering the required services to its members. It also made efforts to reach out to other potential members by visiting them door to door and explaining to them, the power of aggregation. As a result, the number of shareholders in the FPO grew from a meagre 80 (30th April 2013) to 1400 farmers (31st March 2018).

Collective efforts resulted in increased land utilization, yield, productivity and income. In 2013 the FPO was making about 90 thousand as total turn-over and by the end of 2017 the FPO has a total turnover of about 2.6 million. This demonstrates how a member owned and member-managed

organisation, when led by passionate and capable leadership, a supportive promoting agency and a customised financial provider can scale within a brief period.

Leave A Comment