One of the key aspects of Samunnati’s genetic code is to assess a business proposition based on its potential and to provide customised solutions like offering a dairy farm loan for all its customers. Unlike most financial institutions in the country, Samunnati follows a non-traditional method of assessing risk. The assessments are based on the strengths of the cash flows of the borrower and the transactions.

This is the story of a dairy farm, founded by one of Samunnati’s clients, based in Kutch District, Gujarat The client is a resident of Bhavani Par, a small village in Abdasa Taluk of Kutch. She owns about 10 acres of agricultural land in Bhavani Par and was fully dependent on agriculture as a

source of livelihood till 2015. Continuous drought in the region forced her to think of alternative sources of income to meet her children’s education expenses as well as to run the household. Dairy was the most popular alternate source of livelihood in the region and based on the advice of her friends and family, she decided to venture into the dairy business. The client purchased about 5-10 cattle with the dairy farm loan and set up her farm in 2016. She also invested in some dairy related infrastructure using her own resources. Encouraged by the income generated, she aspired to expand the business and tried sourcing funds from Banks. The Banks were unable to lend to her on account of a lack of credit history, audited financials and other documents.

The client approached Samunnati in October 2016 for financial assistance for her dairy farm. A team from Samunnati visited the farm to assess the business and growth potential. After a careful review of the projected cash flows, management capability and the expansion plans, Samunnati sanctioned a 48 month term dairy farm loan of Rs. 26.50 lakhs in November 2016, to purchase cattle and to invest in dairy related infrastructure, with monthly repayments being NACH based. As part of the non-financial services offered by Samunnati, it was also suggested that the client undergoes formal trainings on dairy management, which she completed successfully.

The client drew down the sanction in multiple tranches and has set up a full-fledged dairy farm in Kutch with a milk capacity of 1000 litres a day. As of March 2018, the dairy farm has 70 Jersey cows and a half dozen of calf that are all fully insured. She plans to increase the number of cows to 100 in the near future. The dairy has a milk capacity of 1000 litres a day and the milk is being supplied to a subsidiary of AMUL. The dairy provides full time employment to people, primarily from and around the village. The employees are given living quarters with a doctor on call. The dairy also provides indirect income generation to the villagers by outsourcing supply of green and dry fodder required to the Dairy.

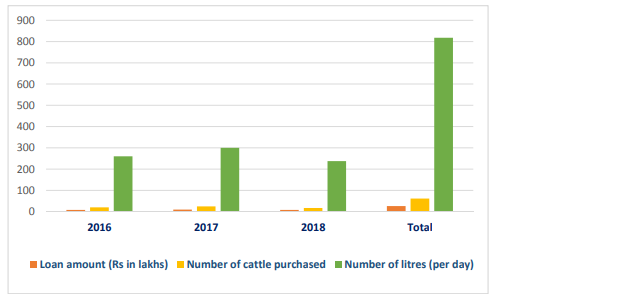

Samunnati team has been periodically monitoring the end use of the loan and the same is found satisfactory. Below is a snapshot of the dairy farm’s growth over the last 3 years:

Encouraged by the business growth, the client has plans to set up a dairy processing plant to produce processed milk and other milk-based products. Given the dairy farm’s growth and performance, funding should no longer be a constraint as the same banks that rejected the client’s application earlier are now keen on offering financial assistance.

Samunnati takes immense pride in having partnered with the client and her dairy farm at its nascent stage and more so in having played a key role in the transformation of a high school pass out housewife into an entrepreneur and role model.

Leave A Comment