Featured in The Economic Times

Chennai-headquartered NBFC Samunnati has launched FPONEXT – an exclusive network of entities that are working with the FPO eco-system via an affiliation programme. The network aims to provide access to financial solutions, market linkages, value added services, technology interventions and other on-tap services to the FPOS at any stage of their formation.

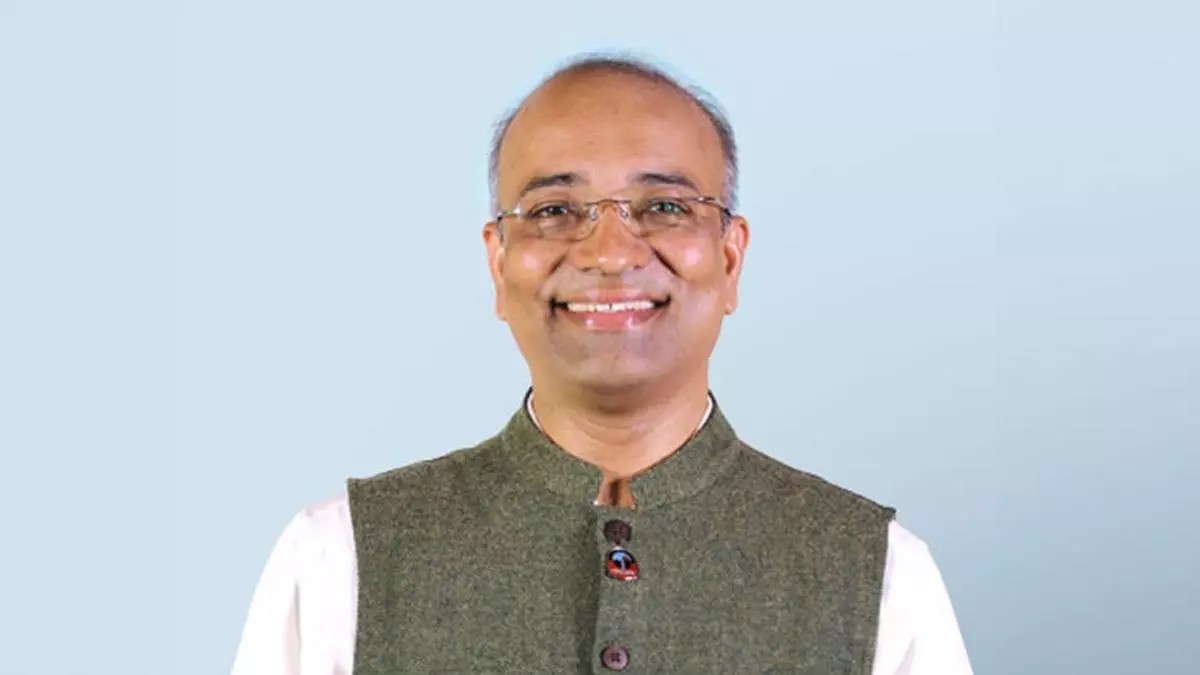

Anil Kumar SG, Founder and CEO, Samunnati said, “With the launch of FPONEXT, we seek to deliver a bouquet of products to FPOs in a more structured manner, aligning to the goals and mission of growth of the agricultural ecosystem.”

Pravesh Sharma, director, Samunnati Agro Solutions said “As India ushers in Agri 4.0, it has become imperative for the industry to create mechanisms which can solve the challenges of FPOS and smallholder farmers across the value chain.”

“FPOS will receive benefits such as pre-sanctioned loans, complementary assessment and feedback from Samunnati through their grading and engagement tool, as well as access to crop, daily weather alerts, market prices and a dedicated call centre. There will also be a focused effort to bring in customized insurance products to the members of FPONEXT,” said Sharma.

Apart from FPOs and Federations of FPOS, Samunnati also plans to onboard Resource Institutions, Producer Organization Promoting Institutions (POPIS), Training and Capacity Building Institutions and other ecosystem players who are committed to FPOS and smallholder farmers. There are entry level benefits which each joining FPO can avail. Members can move from entry level to other levels based on thresholds such as number of transactions through the network-similar to any other affiliation programmes.

“Samunnati shall also provide the member FPOS access to technical knowledge through its partner network (KVKs, Agri universities etc.), commodity research reports, applicable Government schemes and subsidies to help FPOS and member farmers take informed decisions in their crop management. Samunnati shall organize capacity building training and workshops to CEO and BODs on Governance, compliance, management, and business planning,” said Sharma.

He added, “We will continue to offer the existing financial products like working capital loans, term loans that we have been doing over the years. Given our liquidity situation, we would be able to cater to the requirements of all the members of this network without any constraint. We are also exploring working with Banks to offer their financial products to the members of this network through partnerships. In addition, the FPOS of this network will also get handholding support to access very many schemes of Government and other agencies that aim to reduce the cost of finance as well as other financing structures, to the FPOS.” According to the release issued by Samunnati, the NBFC has its presence in more than 100 agri value chains (including pilot) spread over 21 states in India.

Leave A Comment