When farmers come together to solve their problems, a farmer collective is born, which is similar to planting a seed on the soil. But more support – holistically and with a long-term perspective – is needed to help the seed grow and flourish. Samunnati, the largest agri enterprise and an Open Agri Network, does just that by supporting the farmer collectives and helping them become profitable business enterprises. Here is a classic case of investing in the FPCs for greater social impacts.

Avantika Aatm Nirbher Krashak Producer Company Limited (AANKPCL) is a Farmer Producer Company having over 4,600 members from 32 villages across 2 blocks in Agar Malwa district, Madhya Pradesh. Promoted by Reliance Foundation, its membership comprises primarily of small & marginal farmers owning around 2 ha or less and out of the total, nearly a third of them is women farmers.

The region has a large number of processing mills for pulses, millets, soybean, and other crops. Government has also established APMCs in the region to provide platforms for trading of farmers’ produce. The FPC is primarily involved in procurement and sale of commodities such as soybean, gram, wheat, and onion from its members to institutional buyers bypassing the traditional market intermediaries and helping the farmers realize better profits. The FPC is directly supplying soybean of their members to food manufacturing companies such as ITC, NCDEX, Vippi Soya and Ruchi Soya and processing units. The FPC is also acting as the procurement agency for Government of Madhya Pradesh for procuring soybean and gram from the farmers at MSP (Minimum Support Prices).

Avantika works with the soybean farmers since 2010 and has sold produce worth ₹4.6 crores to a large-scale soybean processor and exporter. The FPO sold around 1500 tonnes of soybean to the exporter every year. But there existed a huge potential to double the volumes, for which lack of adequate working capital proved to be a huge challenge as the payment from the exporter takes a minimum of 10-15 days after the goods are supplied. Farmers were also facing financial constraints and always demand payments immediately to manage their domestic expenses.

In the two financial years (2019-20 and 2020-21) owing to the Covid19 pandemic, its business almost came to a grinding halt. The FPO approached several financial institutions including Samunnati for bridging its working capital gap and for procurement loan, which would help it double the volumes and ultimately, help their member farmers realize better returns.

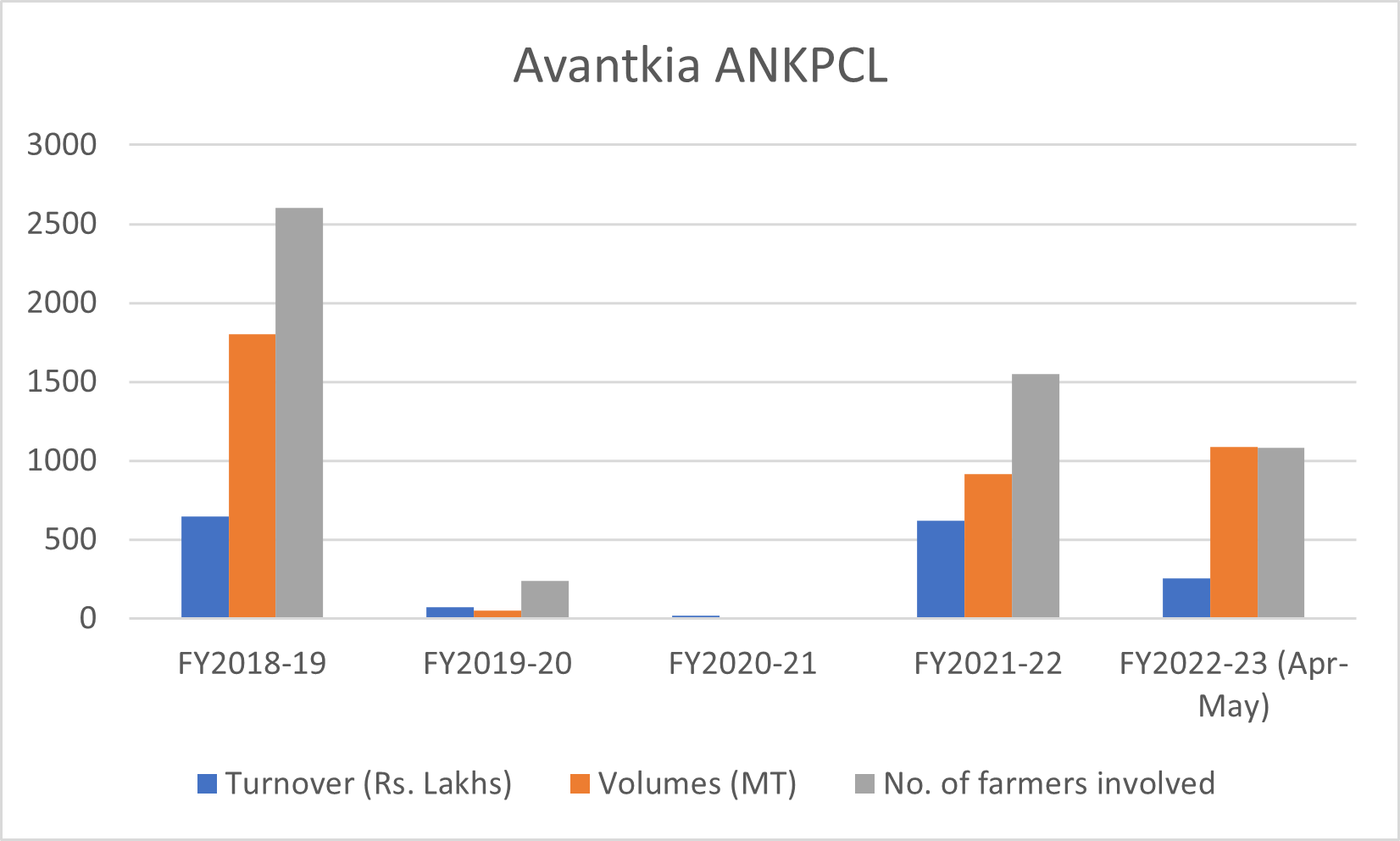

Samunnati holistically evaluated the true potential of the FPO based on its proprietary due diligence processes, strength of the buyer-seller relationship, strong cash flows and future (trade) commitments. Initially, Samunnati sanctioned a loan of ₹50 lakhs as procurement loan in September 2018. The timely intervention encouraged Avantika to procure more volumes directly from nearly 400 farmers and the FPO was able to increase the procurement by an additional 800 tonnes. It borrowed Rs. 2 Crores in multiple loan cycles and has repaid Rs. 1.5 Crores by November 2018. In 2018-19, Avantika’s turnover was Rs. 6.4 Crores from handling around 1800 tonnes of soybean. As the Covid19 pandemic wreaked havoc in the subsequent two years, the FPO’s operations almost ceased.

But with Samunnati’s timely support, in 2021-22, Avantika witnessed a resurgence and its turnover touched Rs. 6.1 Crores while working with about 1550 farmers. With Samunnati’s continued support, in just 2 months of the current financial year (2022-23), Avantika FPO’s volumes surpassed the previous full year (FY2021-22) numbers and crossed 1000 tonnes benefitting nearly 1200 farmers. Through enhanced procurement by the FPC, soybean farmers were able to get Rs. 1500 per Quintal higher than the average price, which translates into nearly Rs. 22000 per hectare.

Avantika FPO was able to increase its volumes, get better rates, enhanced negotiating power, and leverage in the soy value chain. For the exporter, procurement linkage with the farmers aggregated through the FPO proved beneficial at comparatively lower prices than open market mandi-sourced produce. This had a multitude of positive impacts throughout the soy value chain. For the farmers, pre-procurement quality checks and aggregation of produce were done at their doorsteps while they received better prices without incurring any additional costs getting their payment credited directly in their bank accounts almost immediately.

Samunnati continues to holistically support the FPC with its AMLA (Aggregation, Market Linkage and Advisory services) approach and provide customized financial and non-financial solutions tailor-made to its needs.

Leave A Comment