In July 2020, to benefit the farmers for realising better prices for their crops with minimal risk, SEBI has approved the launch of ‘Options in Goods’ in the commodity derivatives segment through Exchanges. NCDEX, one of the Commodities Exchange in India, has launched options trading in specific commodities like Rapeseed–Mustard Seed, Wheat, and Maize (Feed and industrial grade) based on spot prices. What does this contract mean to a farmer who wants to sell his goods?

This options contract allows an FPO or farmer to sell his/her crops on a particular date in the future and at a particular price, by paying a small premium amount. If the price goes higher than the determined price in future, the farmer can still sell at market price by coming out of the option, only at the loss of a small premium. This is a highly flexible and less risky option for an FPO/Farmer which can eliminate price fluctuations. Let us go deep and understand how the scheme works

How the scheme works?

Samunnati works with an objective to make markets work for smallholder farmers by enabling the value chains to operate at a higher equilibrium. Aligned to the vision, Samunnati recently facilitated the execution of the first “Options” trade-in Soybean at NCDEX along with team Kamatan and Madhya Bharat Consortium of FPC. This “Options in Goods” is a better tool for FPOs/Farmers to eliminate their price risk. Options give insurance to the buyers for a specific period.

In the Options market, buyers have the right but are not compelled to buy or sell an asset at a fixed price on or before a given date. On the expiry day, it is the farmers / FPO wish to remain in the options or come out of the option and sell it at the market price. This would give him the flexibility to choose the price at which he wants to sell.

Let us assume the Minimum Support Price (MSP) for Soybean is 3880/ quintal and the market price is 3950/quintal as of 01-Oct. We know that the peak harvest season for Soyabean is in mid-November. So, around 20-Nov, a significant increase in the supply of soybeans could result in a drop in the market price from INR 3950. If a farmer/FPO had goods on 01-Oct, he would have got 3950/ quintal, 70 rupees in addition to MSP of selling soybeans. But what if Farmer does not have goods in hand and want to secure Rs.3950/quintal for 20-November, to get this additional benefit, a farmer / FPO buying an options contract is a useful mechanism.

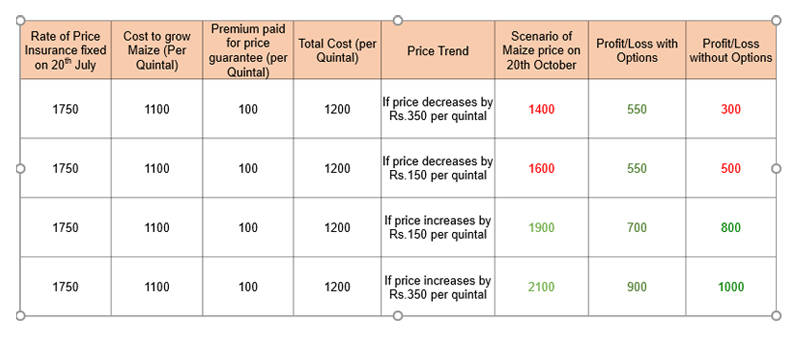

Let us say that a farmer / FPO buys an option. An option gives the farmer / FPO right to sell at a particular price on a particular day. If a farmer buys an option on 20-Jul-20 – A Put option of Maize, strike price 1750 Oct-20 Expiry. Now he has a right to sell Maize at Rs.1750/ Quintal on November 20. For Maize, let’s say there is a reduction of price from 1750 to 1400 on Nov 20, he can still sell it in 1750, as farmer has bought the option. This would give him an extra 350/ quintal compared to then market price. If there is an increase in the price from 1750 to say, 1900, he can still sell it at a market price of 1900, as buying an option is not an obligation to sell, but a right to sell. The only loss to a farmer, in this case, is the premium he paid to buy the option.

Why options trade is better than Futures

To get the same benefit of what we have explained above, A farmer can also sell futures instead of options. But let’s see the difference. A farmer can sell Nov-20 expirySoybean futures @Rs.4100/quintal (prevailing price of futures) for the 10 Tons. This would make the farmer pay 4100*100*10% =Rs.41000 as margin to buy these futures for 10 tons. If there is a reduction in price from 4100 to 3900, he would gain Rs.20000 on market price for 10 tons on 20-Nov-20. But paying Rs.41000 initially as margin is a problem for a farmer / FPO. And in case of price increase from 4100 to 4300, he would be at aloss of Rs.20000 as he is obliged to sell at 4100 only, even though the market price is 4300, as he has sold futures. Options would solve this problem.

If he can buy and Put option instead of a future, for the same price and same date, he would not be required to pay the margin41000 per 10 tons, but only Options premium, for example Rs.5000 for 10 Tons. So, if there is a reduction in price on 20-Nov-20 from 4100 to 3900, he would gain Rs.20000 on 5000 premium that he has paid, resulting in net profit of 15000 rupees. If there is an increase in price from 4100 to 4300, farmer would only lose 5000 premium that he has paid and he can come out of the option and then sell the Soybean at the market price of 4300/quintal. This also results in net profit of 15000 rupees (200*100 = 20000 Rupees – Loss of 5000 premium) for the farmer / FPO. A win – win situation!

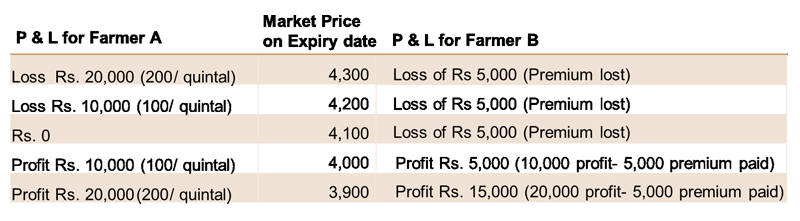

In below table Farmer A sells futures contract at Rs.4100/quintal and Farmer B buys Put option for strike price Rs.4100/quintal

Going forward

Samunnati facilitated the participation of FPOs to hedge their price risk through a newly launched Options contract. Samunnati is planning to engage with multiple FPOs for price risk management through Options in different commodities.

Samunnati will be involved in key activities like educating and spreading awareness to FPOs about “Options in Goods”, benefits to trade in options over futures. Samunnati will also hold a key position to suggest strike prices and expiry dates to stakeholders (Based on an extensive internal study on harvest season peaks and MSP by the government).

Leave A Comment